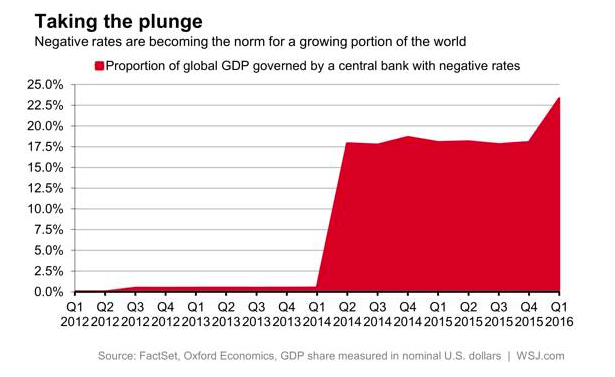

A major trend in the world economy is for Central Banks to favour reducing interest rates to negative levels in an attempt to spurn financial growth. Currently, economies that account for about 25% of global economic output are governed by negative rates and this is trending higher. It’s OK to be excited about lower mortgage rates, but you should also be concerned about our increased dependency at the macro level to rely on such low rates.

As more economies adopt a low to negative rate strategy there is little doubt fixed assets will continue to increase in price, up to a point. When cheap money floods into the market for an extended period of time that money is gobbled up by two main types of people: those who use the money to invest in more fixed assets and alternative investments, and those who use the money primarily to finance their lifestyle.

At a certain point, will rates not have to increase? Of course. But, will they continue to decline first? How much lower can they go if zero is no longer an absolute bottom, and how long can they stay low? These are important questions for anyone attempting to predict the end of our incredible housing market. Saying nothing of the myriad other factors at play (foreign investors, supply side constraints, etc.), if people are able to borrow at increasingly low rates it will be difficult for our effervescent housing market to fizzle out.

Would you consider buying a home if the prime rate went to 0.50% and you had a variable rate mortgage at prime minus 0.50%? We are hearing funny reports of Dutch homeowners being paid to hold a mortgage. That’s because their mortgage rates are tied to the Swiss interbank lending rate which went negative and, as result, the homeowners reap the benefit. Although this is highly unlikely to happen in Canada because of the gap between our Overnight Rate and our Prime Rate, it is an important point for perspective. Our current lending rates are so low that people are motivated to borrow because of them, to borrow for the sake of borrowing. The promise of low rates for an extended period of time, which is what we’re beginning to hear from Central bankers around the world, is as reassuring as the promise of even lower rates themselves.

On the other hand, while fixed rate mortgages in Canada continue to trend lower, the media issues ever louder warnings that our real estate market is a massive bubble one pin prick away from explosion. Toronto and Vancouver home values are increasing at unsustainable levels, many Canadians can’t afford to buy a home, foreign investors are pushing everyone else out of the market. And yet, interest rates continue to drop.

Meanwhile, it appears as though the Canadian Government is preparing to unleash some new policy or policies upon our vaunted housing market squarely aimed at reducing housing and consumer debt. But it is hard to imagine a policy that will change the current behavior of Canadians in an environment where real estate prices are skyrocketing higher and interest rates continue to decrease. Policy for the sake of policy seems to be the order of the day. No one can predict the unintended consequences of whatever the government decides to implement to show that they take the problem seriously. Simply put, the threat that interest rates will soon rise no longer carries the potency that it once did. More Canadians are starting to understand that we might be in for a longer period of low rates than was initially forecasted. And at least in Toronto and Vancouver, policy interventions are effectively guaranteed to fail, because as BMO’s latest report says, “none of the major drivers of Vancouver and Toronto’s housing market are pointing downward” says the latest report from BMO.

Yesterday the US Federal Reserve Chair Janet Yellen remarked that the “forces holding down growth and interest rates may be long lasting”. This paints a very important picture to someone looking toward the future. The Federal Reserve has slowly shifted their verbiage to a position of uncertainty on the economy. Expect more of this in the future as the Fed is being governed by the markets and understands that increasing rates could result in a massive drop in assets prices that will be far more difficult to recover from than the previous depressionary hiccup we are still grappling with. In the meantime investors will continue to crown into low risk investments in an attempt to glean some yield in a decreasing rate environment.

In short, don’t be fooled by the low fixed rate offerings out there. Two or three years ago media experts were suggesting you jump on a 10 year fixed mortgage at 3.5%. Aren’t you glad you didn’t listen? Take a variable rate mortgage and stick with it. At some point rates will increase, but likely not before they go lower. Take the savings when they’re on the table. At some property values will drop, so don’t invest based solely on the expectation of appreciation. At some point the economy will need to correct itself, and at some point we will need to go back to functioning without 0% interest rates. But when?